Create Your Own Auto Insurance Card in 5 Minutes

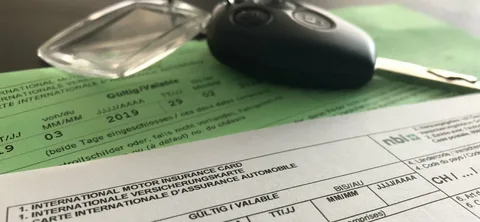

An auto insurance card, also known as an insurance identification card or ID card, is a document issued by your insurance company as proof that you have active auto insurance coverage. It serves as evidence that you comply with the minimum liability insurance requirements mandated by the state where you reside and operate your vehicle.

The primary purpose of an auto insurance card is to demonstrate to law enforcement officers and other relevant authorities that you have met the legal obligation to maintain adequate insurance coverage for your vehicle. In most states, driving without valid insurance is considered a traffic violation that can result in fines, license suspension, or even vehicle impoundment.

Information Included on an Auto Insurance Card

An auto insurance card typically includes the following key details:

Policy Number: This is a unique identifier assigned to your specific insurance policy. It helps insurance companies and authorities quickly access your policy information.

Coverage Details: The card outlines the types of coverage you have purchased, such as liability, collision, comprehensive, and any additional endorsements. It specifies the coverage limits and deductible amounts for each type.

Insured Driver Information: The card lists the name(s) of the driver(s) insured under the policy. This information is crucial as it identifies who is covered to operate the vehicle.

Vehicle Information: Details about the insured vehicle(s) are provided, including the make, model, year, and vehicle identification number (VIN).

Policy Effective Dates: The start and expiration dates of your insurance policy are clearly stated, indicating the period during which your coverage is active.

Insurance Company Information: The name, contact information, and sometimes the logo of the insurance company that issued the policy are prominently displayed on the card.

Policy Number

An auto insurance policy number is a unique identifier assigned to your specific insurance policy by your provider. This number serves several important purposes:

- It helps insurance companies accurately track and manage your policy information and coverage details.

- It allows you to easily reference your policy when communicating with your insurer or filing a claim.

- It ensures that any claims or transactions are properly associated with your specific policy.

The policy number is typically a combination of letters and numbers that distinguishes your policy from others held by the same insurance company. It’s a crucial piece of information that should be readily available on your auto insurance card or policy documents. Whenever you need to provide proof of insurance or make an insurance-related inquiry, having your policy number handy streamlines the process and ensures efficient handling of your requests or claims.

Information Included on an Auto Insurance Card

An auto insurance card typically includes the following key information:

Liability Limits

The liability limits on your insurance card indicate the maximum amount your insurance company will pay for injuries or property damage you cause to others in an accident. Liability coverage usually shows two numbers, such as 50/100 or 100/300. The first number is the limit for bodily injury per person, and the second number is the total limit for bodily injury per accident. Some states also require property damage liability limits, which cover damage to another person’s vehicle or property.

Deductibles

Your deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Your auto insurance card will list the deductible amounts for comprehensive and collision coverage. Common deductible amounts range from $250 to $1,000, with higher deductibles resulting in lower premiums.

Information Included on an Auto Insurance Card

Your auto insurance card typically includes the following key details:

Name and Address

The card displays the name and address of the policyholder, which helps identify the insured individual or entity.

Vehicle Information

It lists the make, model, year, and vehicle identification number (VIN) of the insured vehicle(s) covered under the policy. This information is crucial for verifying coverage for a specific vehicle.

Policy Number and Effective Dates

The policy number and effective dates (start and expiration dates) are provided, allowing you to confirm the validity and active status of your insurance coverage.

Coverage Types and Limits

The card outlines the types of coverage you have purchased, such as liability, collision, comprehensive, and any additional endorsements. It also specifies the coverage limits or maximum payouts for each type of coverage.

Insurer Information

The name, contact information, and potentially the logo of the insurance company that issued the policy are included on the card for easy reference and communication with the insurer if needed.

Why You Need an Auto Insurance Card

Having an up-to-date auto insurance card is crucial for several reasons:

Legal Requirements

Most states require drivers to carry proof of insurance in their vehicles at all times. Failing to do so can result in fines, license suspension, or even vehicle impoundment. An auto insurance card serves as legal documentation that you have the minimum required liability coverage.

Proof of Insurance

If you’re involved in an accident, law enforcement or the other parties involved will likely ask to see your insurance card. It provides proof that you have active coverage and includes essential details like your policy number, coverage limits, and the insurance company’s contact information.

Traffic Stops

During routine traffic stops, police officers will often request your driver’s license, vehicle registration, and proof of insurance. Presenting a valid auto insurance card can help avoid penalties or complications during these encounters.

How to Get an Auto Insurance Card

When you purchase auto insurance, your insurer should provide you with a card as proof of coverage. There are a few different ways to obtain your insurance card:

Request From Insurer

Most insurers will automatically mail you a hard copy insurance card when you first purchase a policy. If you need additional cards or replacements, you can typically request them directly from your insurance company by phone, email, or through their website/app.

Print Temporary Cards

Many insurance companies allow you to log into your online account and print out temporary insurance cards on standard computer paper. While not as durable as the official cards, these printouts can serve as valid proof of insurance in the interim.

Mobile Apps

Most major insurers now offer mobile apps that store digital copies of your insurance cards. These apps make it easy to access your proof of insurance directly from your smartphone or device. Some apps even include functionality to email or text a copy of your card when needed.

No matter which method you use, be sure to keep your insurance card(s) in your vehicle at all times. Law enforcement can request proof of insurance during traffic stops.

Auto Insurance Card Template

An auto insurance card template is a downloadable file that allows you to create your own custom insurance card. These templates typically come in a standard format with fields that you can fill in with your personal information and insurance details.

Most auto insurance card templates are designed to be easily customizable, allowing you to input your name, policy number, insurance company information, coverage dates, and other relevant details. Some templates may also include fields for additional information like vehicle make and model, VIN number, or contact information for your insurance agent.

Once you’ve filled out all the necessary fields, you can print the insurance card template on a standard sheet of paper or card stock. It’s generally recommended to print the card on a thicker, more durable material like card stock or heavy paper to ensure it holds up over time.

When printing your auto insurance card template, be sure to use a high-quality printer setting to ensure that all the information is clear and legible. It’s also a good idea to print multiple copies, so you have extras on hand in case you need to replace a lost or damaged card.

Many insurance companies also offer digital or electronic versions of their insurance cards, which can be accessed and displayed on your smartphone or other mobile device. However, having a physical printed card can still be useful as a backup or for situations where a digital version may not be accepted.

State-Specific Requirements

While auto insurance cards share some common elements across the United States, each state has its own specific requirements regarding the information that must be included on the card and the penalties for non-compliance.

For example, in California, the auto insurance card must display the policy number, effective dates, vehicle details, and minimum liability limits of $15,000 for injury/death to one person, $30,000 for injury/death to multiple people, and $5,000 for property damage. However, in Texas, the minimum liability limits are $30,000 for injury/death to one person, $60,000 for injury/death to multiple people, and $25,000 for property damage.

Penalties for Non-Compliance

Failing to carry a valid auto insurance card or provide proof of insurance when requested can result in penalties that vary by state. Common penalties include:

- Fines (ranging from $100 to $1,000 or more)

- Vehicle impoundment

- License suspension

- Jail time (in some states for repeat offenses)

In some states, like New York, simply failing to have an insurance card in the vehicle can result in a traffic citation and fine, even if the driver has valid insurance coverage. Other states may only penalize drivers who cannot provide any proof of insurance after being stopped.

It’s crucial to understand and comply with your state’s specific auto insurance card requirements to avoid potential legal and financial consequences.

FAQs about Auto Insurance Cards

Do I need to carry my auto insurance card with me at all times?

Most states require drivers to carry proof of insurance in their vehicle at all times. Failing to provide proof of insurance when requested by law enforcement can result in fines or other penalties. It’s recommended to keep your current auto insurance card in your vehicle.

What should I do if I lose my auto insurance card?

If you lose your auto insurance card, contact your insurance company as soon as possible to request a replacement card. Many insurers also provide digital insurance cards or allow you to access your policy information through their mobile app or website.

Can I use a digital auto insurance card instead of a physical card?

Many states now accept digital proof of insurance, such as a photo or PDF of your insurance card stored on your smartphone. However, laws and regulations regarding digital insurance cards vary by state, so it’s essential to check your local requirements.

How often should I update my auto insurance card?

You should update your auto insurance card whenever you renew your policy or make changes to your coverage. Insurance companies typically send new cards when your policy is renewed or updated.

Are there additional resources for understanding auto insurance cards?

Yes, here are some additional resources that can provide more information about auto insurance cards:

- Your state’s department of motor vehicles website

- Your insurance company’s website or customer service representatives

- Online guides and articles from reputable insurance industry sources

Remember, it’s always best to check with your specific insurance provider and local regulations for the most up-to-date and accurate information regarding auto insurance cards in your area.